📰 Central Banks Demand Trust — Bitcoin Delivers Trustlessness

Bitcoin: the solution to the "cost-of-trusting-central-bankers-with-our-money crisis"

In a recent exchange at the World Economic Forum (WEF) in Davos, the Bank of France Governor François Villeroy de Galhau voiced a perspective many Bitcoiners view as arrogant ignorance. He claimed to place greater trust in “independent central banks with a democratic mandate” than in what he called “private issuers of Bitcoin.”

The problem with that statement is that it’s factually wrong. While it is indeed correct when talking about “crypto”, Bitcoin is different. Coinbase CEO Brian Armstrong delivered an immediate and calm correction: “Bitcoin is a decentralised protocol,” he replied. “There’s actually no issuer of it.” He went further: in the very sense that central banks claim independence, Bitcoin is even more independent—there is no country, no company, and no individual anywhere in the world that controls it.

This short clip exposed a profound philosophical divide: legacy monetary systems built on centralised control and endless trust versus Bitcoin’s separation of money and state, where trust in humans is (today and always will be) unnecessary.

The Painful Ignorance and Arrogance of Those Stealing Our Wealth

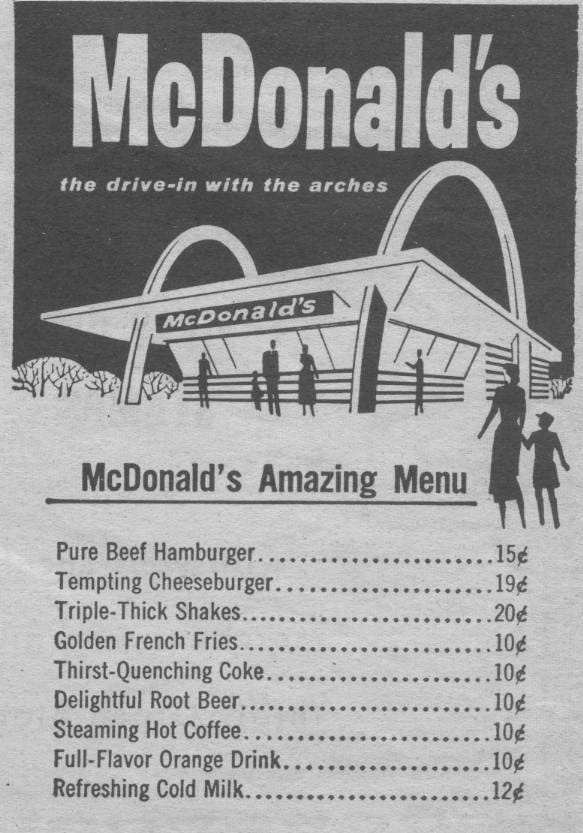

Fiat currencies, whether the US Dollar, British Pound, Iranian Rial, or any other, are created and managed by central institutions with monopoly power over issuance. Central banks decide when (and how much) to expand or contract the supply, often through opaque mechanisms shielded from real-time public scrutiny. That power is delegated by governments, but it remains centralised in fallible human hands. Every single human being on the planet has had their money diluted and devalued by central bank policies—stealthy theft via inflation that erodes savings, wages, and purchasing power year after year.

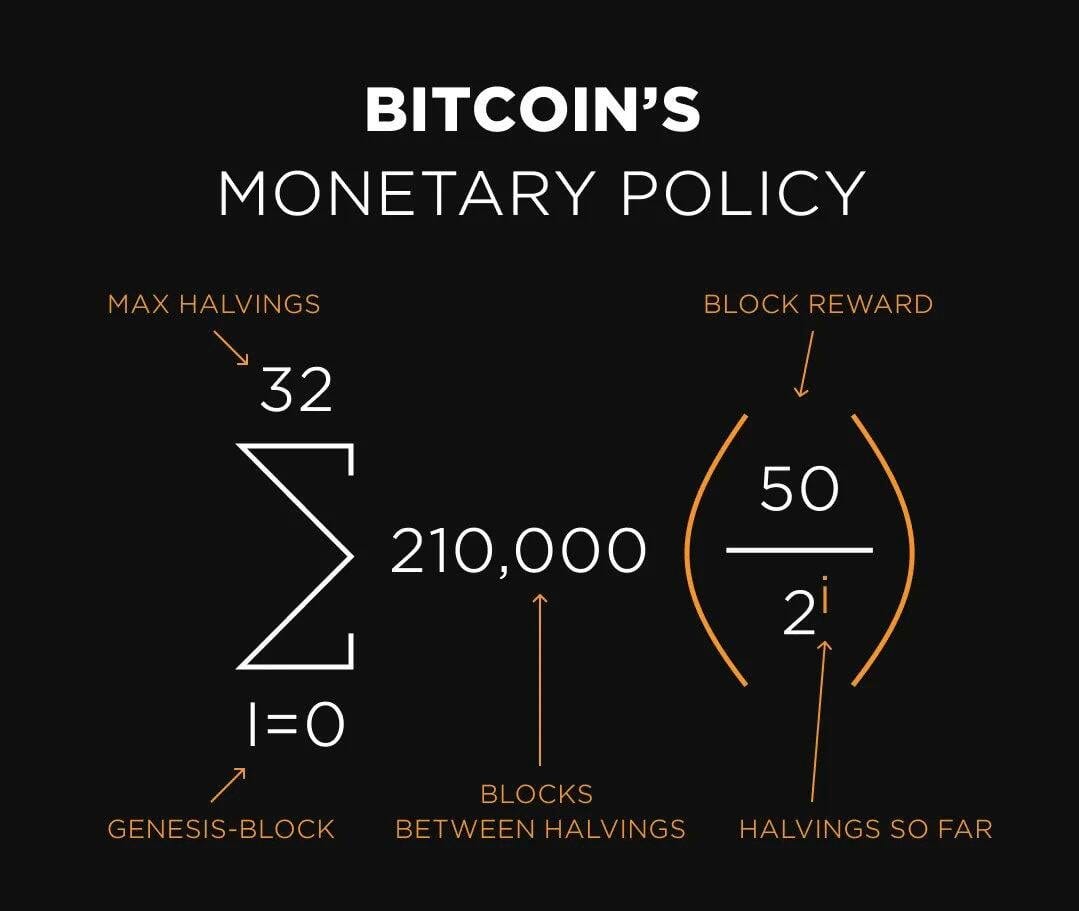

Bitcoin operates entirely differently by design. There are no bailouts. Its rules were set in 2009 by the pseudonymous creator known as Satoshi Nakamoto, who later disappeared. Since the genesis block, new bitcoin enters circulation through a fair, predictable, and transparent process: miners compete to add a new block of transactions to the timechain approximately every 10 minutes, incentivised by transaction fees and a block reward that halves roughly every four years or precisely every 210,000 blocks. It began at 50 BTC per block; after the most recent halving in April 2024, it is now 3.125 BTC per block. The total supply is mathematically capped at 21 million coins, with the issuance schedule hardcoded and unchangeable without near-unanimous network consensus. The immense energy used in Bitcoin mining is to protect these rules. The final bitcoin is projected to be mined around the year 2140. Although in just a few months, there will be only 1 million bitcoin left to be mined for the next 100+ years. Act accordingly and don’t say we didn’t warn you!

There is no boardroom, no governor, no finance minister who can vote to print more bitcoin to fund deficits or foreign wars, prop up asset bubbles, or cave to political pressure. All issues which are as old as money itself. The protocol has no CEO, no shareholders, and no headquarters. Attempts to alter core rules (such as increasing the supply cap/diluting the money) have always failed because changes require overwhelming social consensus across miners, nodes, exchanges, wallets, and users—not top-down decree.

Trust in Central Banks vs. Trustlessness in Bitcoin

Governor Villeroy emphasised that central bank independence, combined with democratic accountability, provides the “guarantee for trust.” This rests on the naive belief that elected representatives and appointed officials, somehow insulated from short-term politics, can manage money responsibly over the long term. “Trust us, bro!”

Whilst these individuals and institutions may have the best intentions, they have no moral authority, as history tells a different story. Regardless of the politics du jour in every jurisdiction, the wealth cap only increases over time as central banks have repeatedly presided over outright currency debasement and recurring crises of confidence. Even “independent” institutions buckle under pressure during recessions, wars, or populist shifts. Officials remain beholden to voters, politicians, and powerful lobbies that almost always prioritise short-term stimulus over long-term stability. Bitcoin was created precisely to eliminate this vulnerability. As Satoshi Nakamoto explained in 2009:

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

Bitcoin takes the opposite path. It asks no one to trust a person, institution, or government. Trust is replaced with verifiable proof. Anyone can:

Run a full node to independently confirm every transaction and block against the rules.

Audit the entire monetary policy by inspecting the open-source code.

Verify the 21 million cap is enforced without relying on third-party promises.

“Trustless” does not mean something negative—it means you don’t need trust. Mathematics, cryptography, and aligned economic incentives do not require trust in fallible bureaucrats—they just work!

Central Banks Do Not Deserve Our Trust

Armstrong pointed out that users (not panels, regulators, or governors) ultimately decide where trust belongs. People sensitive to inflation, capital controls, or institutional corruption have already begun opting out. Bitcoin adoption, although volatile, has been in a super cycle since inception, while fiat currencies have steadily (and sometimes catastrophically) lost purchasing power, eroding trust in the system itself. Naturally, central bankers prefer the status quo, where they retain control and can engineer short-term “stability” through money printing and intervention. Bitcoin delivers the real alternative: predictable scarcity, borderless transfer, and immunity to arbitrary meddling. It requires no permission, no democratic vote, and no faith in officials.

The comments at Davos by the Bank of France Governor were a public embarrassment for central bankers and a wake-up call for the plebs around the world, working three jobs in the fiat mines just to live a normal life. For those struggling with the affordability crisis or the cost-of-living crisis (more accurately… the cost-of-trusting-central-bankers-with-our-money crisis), the question is no longer whom to trust. It’s whether centralised trust is necessary at all.

⚠️ Disclaimer

The Bitcoin Mindset Newsletter is interested in low-time preference thinking and how FreedomTech (Bitcoin, Nostr, encryption, the internet etc) can help build a better and freer future. Like Bitcoin, this newsletter is politically non-partisan; Bitcoin is for everyone! The content we share (including videos, memes, books & social media accounts) does not necessarily reflect the views of this newsletter.

We don’t cover financial advice, shitcoinery, trading tips, or get-rich-quick schemes. Whilst fiat mindsets chase pumps, Bitcoiners are building a better world for future generations. Everything here is for informational purposes only and should never be mistaken for financial, investment, or legal advice.

Being self-sovereign comes with responsibility. Don’t trust—verify. Do your own research and think for yourself. After reading this newsletter, don’t buy Bitcoin—study it.